5 Problems Facing Space Exploration Today?

The following 5 problems facing those who wish to get in on Space Exploration and Space Commerce must understand the current situations. Space Commerce and Space Exploration will be very lucrative businesses of the future. Providing new businesses can get funding without crippling them before they start..

Before humans can inhabit space, asteroids, the moon, Mars or any other planet we must first overcome the number one problem (end of our list), and the second biggest problem. Government always wants to complicate matters by making rules and regulations that prohibit small businesses from participating or just to get started. Rules and Regulations are necessary and must be in place but in the beginning of this industry Rules and Regulations must be in a relaxed state to help build the industry. This will encourage fast development in all areas needed to for the safety and profitability of all involved.

#5 Speed needed to travel within our Solar System

Our current speed record for space is around 38,000 mph attained by Voyager 1 & 2 was a little less. It took 35 years for them to reach the edge of our solar system. The speed that we need to attain is 10 to 20 million mph this will allow us to get to edge of our solar system in four months or less. At that speed we encounter many new obstacles such as slowing down. We are sure once we attain these speeds we will have figured out how to slow down. It is our belief that once we reach one third the speed of light that dust particles and even large objects will be disintegrated or will follow the edge of the envelope that is created. These are things we are working on at Astral Center for Starship R & D

#4 Technology needed for Human Survival

- Life support–water, oxygen, food, waste (human & other), electricity (energy sources) for equipment,

- no gravity–our bodies begin to adapt by loosing bone mass and if the air we breath isn’t filtered well we suffer from chronic illnesses

- Technology needs to be developed to ensure the survival of humans in space..

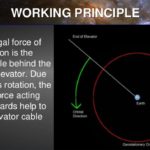

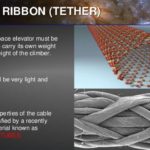

#3 is the mode of getting to space

Currently we use Rockets and fuel tanks (Space X and Blue Origin are still working on reusable rockets). This mode of transportation is outdated and obsolete. The cost to develop other methods of transportation is still extremely expensive.

#2 is Politics and Government Regulations

Rules and Regulations are necessary for many reasons but this industry will need every country and every political body on the planet to work together to make space accessible to everyone. This will mean that in the beginning we will need streamlined methods for companies to apply for and receive permission to build, travel, and explore space freely. Space Commerce has the potential to make the worlds first Trillionaires and governments can fill their coffers with

#1: The Lack of Money

Have you ever asked why we aren’t traveling in space today?

#1 Money was and is the primary reason and #2 Politics was the second. Governments have the problem of budgets and pleasing their constituents (you and I). Other programs took precedent over the space program.

When we began using the Space Shuttles over 40 years ago most Americans thought that we were well on our way to becoming space travelers.

Answer the following questions and you will discover that it all comes back to money.

Why wasn’t the Space shuttle ever upgraded to last well into the future?

Why was it canceled? Wikipedia gives some insight to this question here.

Why aren’t we going to space everyday? After all it has been almost fifty years since we set foot on the moon.

What happened to making space accessible to everyone?

1st Space Bank will solve this problem by financing all space projects now and in the future.

How you ask?

When you deposit your currency into a 1st Space Bank account you will receive the equivalent amount in the new currency, ***All currencies will be converted at their current exchange rates to British Pounds. British Pounds to Sollars = 13.5 times

- By creating a new global system that can be accessed from anywhere on Earth and in our solar system.

- It also requires that we create a new currency that exceeds all Earth based currencies. For now we are calling it Sollars (sol-larrs) or Solar Credits.

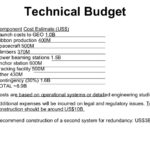

- The bank will be funded with 999 quadrillion Sollars or Solar Credits. This will ensure that we can finance the Mega Projects of the future as well as finance colonies on the moon, Mars or an asteroid. Our goal is to advance the human exploration of space in as little as 10 years.

- As with Bit-Coin–acceptance of the new currency will require that everyone and all governments get on board and accept it.

- We need to face the simple fact that there just isn’t enough money on Earth to finance space research, development, or finance new technology that is needed to get us off the planet. Let alone find ways that will help insure the survivability of humans in space or on another planet.

- Government space programs can be funded through us by depositing their currency into our bank and receiving the equivalent amount (£ = 13.5 Sollars) on deposit. No need to borrow money unless you want to or you want to accelerate your space programs.

- The requirement is that anyone that wishes to contract with one of our clients should have an account with us but isn’t necessary and the contract must be in the currency of the country of origin. Example: NASA wants to do business with Company X, Company X gives NASA their bid in British Pounds. NASA then uses 1 Sollar for 1 British Pound (converting British Pounds to USD) to purchase the services of Company X. Company X then deposits the British Pounds into their account at 13.5 times. Thus giving them the ability to purchase more goods and services from others.

- Anyone or any company can use the bank and take advantage of the exchange rate currently being offered. In the future we will have in place a matrix or index that is used to value the new currency. It will not be tied to any Earth based currency instead use an index of precious metals and precious stones. The current exchange rate was determined using this method. It will follow the same principals as the Dow Jones Industrial Averages or any other Exchange.

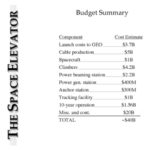

Using our new currency 1st Space Bank will finance the technology to build these mega projects and more. We have set up three prizes to anyone that can design and build a Space elevator, asteroid mining technology, new cutting edge technology that will make rockets obsolete.

Why make so much money available to everyone? We believe that we are long overdue for a catastrophic event that could wipe out humanity. Putting that aside it is the next logical step in our evolution.

Once we are in space we face many other obstacles.

Besides the obvious like no oxygen, water, and gravity. Radiation protection is another obstacle. I will continue this as time permits.

Other Problems Facing Space Exploration?

The following list is to show a few of the problems we face in space and all of it requires lots of money. Everything we do in space always comes back to the major obstacle facing all of us to get into space and that is MONEY. If you don’t have enough of it you cut corners or purchase O-rings that aren’t suited for the job. Cutting corners to save money is a devastating method for space exploration. We lost lives on the Challenger in 1986 because of it, as well as Colombia in 2003.

Other problems facing space exploration are:

The list is forthcoming.